In simple terms, bookkeeping is organizing financial the financial transactions that occur in a business. This includes purchases, sales, receipts, bank deposits and payments by an individual or organization. Here’s a breakdown of the key aspects:

- Recording Transactions: Every sale, purchase, payment, or receipt of money is recorded. This is done in journals or ledgers, which are essentially detailed logs where each transaction is entered with a date, description, and amount.

- Categorizing: Transactions are classified into relevant accounts. For instance, sales go into an income account, rent goes into a rent expense account, etc. This categorization helps in understanding where money is coming from and where it’s going.

Why is Bookkeeping Important?

- Financial Health: It provides a clear picture of the financial health of a business, showing profitability, cash flow, and financial trends over time.

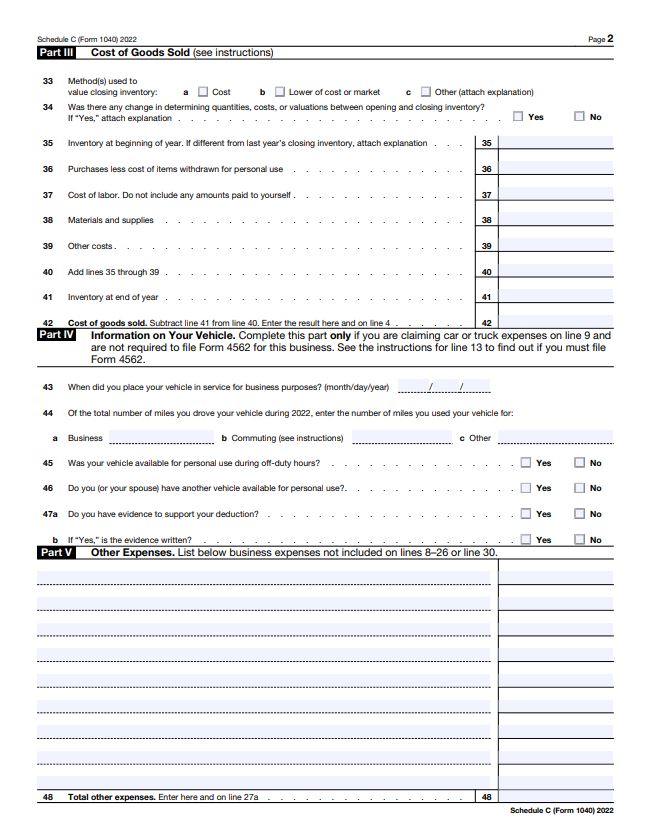

- Legal Compliance: Accurate bookkeeping is essential for tax purposes. It ensures that businesses can comply with tax laws, file accurate returns, and avoid penalties.

- Decision Making: With precise financial data, business owners and managers can make informed decisions, from daily operations to strategic planning.

Bookkeeping for a small business or sole proprietor

A bookkeeping system for a micro business or a sole proprietor should be simple yet effective, ensuring that all financial transactions are recorded accurately while being easy to manage. The first step is choosing a method. There are three basic methods for bookkeeping:

- Manual Bookkeeping: Use a simple ledger book or notebook. This is cost-effective but can be time-consuming and prone to human error.

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets are accessible, flexible, and allow for basic calculations and data organization.

- Bookkeeping Software: Options like QuickBooks, Wave, or FreshBooks are tailored for small businesses, offering automation, invoicing, and basic financial reporting. Many have free or low-cost versions suitable for small businesses.

Which method should you choose?

For someone just starting a business, simple is usually better. You will be busy working on your business and won’t have a lot of time to spend on bookkeeping. Manual bookkeeping is the simplest but also takes up a lot of time. Bookkeeping software is the most complicated and takes a lot of time to maintain. It’s my opinion that a basic spreadsheet system is the simplest and easiest bookkeeping method for someone just starting out or someone with a micro business that doesn’t have invoicing or employees.

Writing stuff down in a notebook doesn’t require any explanation and bookkeeping software requires full tutorials to use that I don’t have the space for here, I’m going to focus on using Spreadsheets.

Pros of using spreadsheets for bookkeeping

- Cost effective:

- Google Sheets is free with a Google account. A subscription to Microsoft Office that includes Excel is $6.99 a month or $69.99 a year.

- Accessibility:

- Being cloud-based, you can access your financial data from any device with internet access. Work remotely from anywhere.

- Customization:

- You have complete control over the set-up and layout of your spreadsheets. You can customize them to fit your exact bookkeeping needs.

- Integration:

- Google Sheets integrates with other Google services like Google Drive and Excel integrates with the other Microsoft Office products. Both also have add-ons that can enhance functionality.

- Backup and Recovery:

- Automatic saving and the ability to revert to previous versions provide some security against data loss.

- Automatic Updates:

- Google and Microsoft regularly update the applications, adding new features or improving existing ones at no cost to you.

Cons of using Spreadsheets for bookkeeping

- Limited Automation:

- Spreadsheets don’t automatically import and categorize transactions. This is where www.nobookkeeping.com can help!

- Scalability:

- Spreadsheets can get you started, but if your business really takes off in a year or two, you will probably need some accounting software or professional help.

- Compliance:

- Spreadsheets won’t offer any tips on tax laws or accounting standards.

- No Sophisticated Reporting:

- The spreadsheet is the report.

For many small businesses or sole proprietors, spreadsheets can be an excellent starting point for bookkeeping, particularly when funds are limited, and the business operations are simple. However, as the business grows or transactions become more complex, you might find the need to transition to more specialized bookkeeping software or consider hiring a professional accountant. Remember, the key is maintaining accurate, organized records regardless of the tool used.