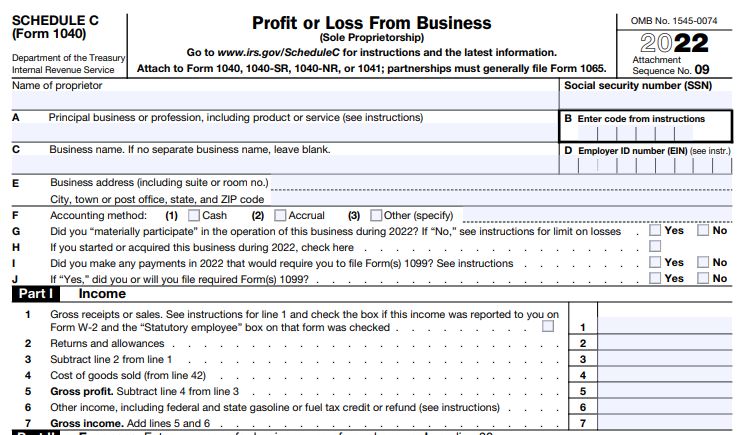

A Schedule C is the tax form people use to report self employment income on their tax return. It is a form that gets added to your 1040 form. If you are a sole proprietor you can use a schedule C.

What does a Schedule C do?

Schedule C calculates your net income from your small business. You enter your sales at the top and then your expenses below that. When you subtract your expenses from your sales, you get your “net income”. Your net income is used to calculate your self employment taxes and your income taxes.

What goes on a Schedule C?

Part I

Part I calculates your gross income. Gross income is all your sales and revenue before you subtract any expenses.

Line 1 is your gross receipts. Depending on what your business is and how you get paid, there are different ways to calculate this number.

If your business sells items to lots of different customers thorough a webstore or a marketplace like Etsy or Amazon you can add up your bank deposits to get this number. If you have a physical store that sells items, adding up your bank deposits will also give you this number. There are also a lot of Point of Sale systems that will track this number and give a report you can use.

Hair stylists, massage therapists, and other businesses like them can usually just add up all of their bank deposits to get this number.

If you are an independent contractor and you get a 1099, or several 1099’s, add up your 1099’s to get your gross receipts. If you also have income that is not on a 1099, add this to your 1099 total.

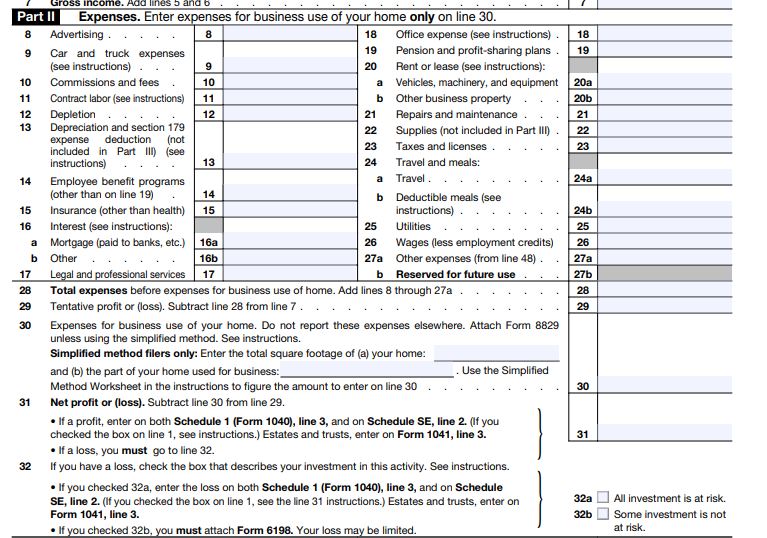

Part II

Part II of Schedule C is where you enter your expenses.

Your expenses are all of the things you spent money on to earn the money you made in Part 1. The schedule has lines for expenses such as: advertising, rent, repairs and maintenance, legal fees, travel, and utilities.

There is also a line for “Other expenses”. Line 27 is the total of your expenses that you entered in Part V. Any expense you have that does not fit one of the categories in Part II goes in Part V and the total goes on line 27a. (I don’t know why they don’t just let you list everything in Part II)

After you add up all of your expenses and put that total on Line 28, you subtract that number from your gross receipts. This your “Tentative profit or loss” and gets entered on Line 29. It’s tentative because if you have a home office, that expense gets entered on line 30.

After you subtract your home office, if you have one, the number you get is your net profit or net loss. If it’s a net profit, you pay taxes on it. If it’s a net loss you may be able to deduct it from any other income you have.