Actual Expenses vs. Standard Mileage Rate

If you use your car for business purposes, you may be able to deduct the cost of operating your car as a business expense. There are two ways to do this: you can use the standard mileage rate, or you can itemize your actual expenses.

The standard mileage rate is a fixed amount that the IRS sets each year. For the 2023 tax year, the standard mileage rate for business use is 65.5 cents per mile. This means that if you drive 100 miles for business purposes, you can deduct $65.50 from your taxable income.

To use the standard mileage rate, you must keep a log of all the miles you drive for business purposes. The log should include the date, the purpose of the trip, and the number of miles driven. You can use a simple spreadsheet or a dedicated mileage tracking app to keep your log.

You can also use the standard mileage rate if you lease your car for business purposes. However, if you lease your car, you must use the standard mileage rate for the entire lease period. You cannot switch to the actual expense method in later years.

If you choose to itemize your actual expenses, you can deduct the cost of all of the expenses that you incur in operating your car for business purposes. This includes the cost of gas, oil, repairs, insurance, depreciation, and any other expenses that are directly related to the use of your car for business.

To itemize your actual expenses, you must keep detailed records of all of your expenses. This includes receipts, invoices, and any other documentation that supports your expenses.

The standard mileage rate is generally a more convenient option than itemizing your actual expenses. However, if you can itemize your actual expenses and the total amount of your expenses is more than the standard mileage rate, you may be able to deduct more by itemizing.

Requirements for Taking the Deduction

To take the standard mileage deduction, you must meet the following requirements:

- You must use the car for business purposes.

- You must keep a log of all the miles you drive for business purposes.

- You must own or lease the car.

- You must not have claimed a depreciation deduction for the car in any previous year.

If you meet all of these requirements, you can deduct the standard mileage rate from your taxable income.

Calculating the Deduction

To calculate the standard mileage deduction, you multiply the standard mileage rate by the number of miles you drove for business purposes. For example, if you drove 10,000 miles for business purposes in 2023, you would deduct $65,500 from your taxable income.

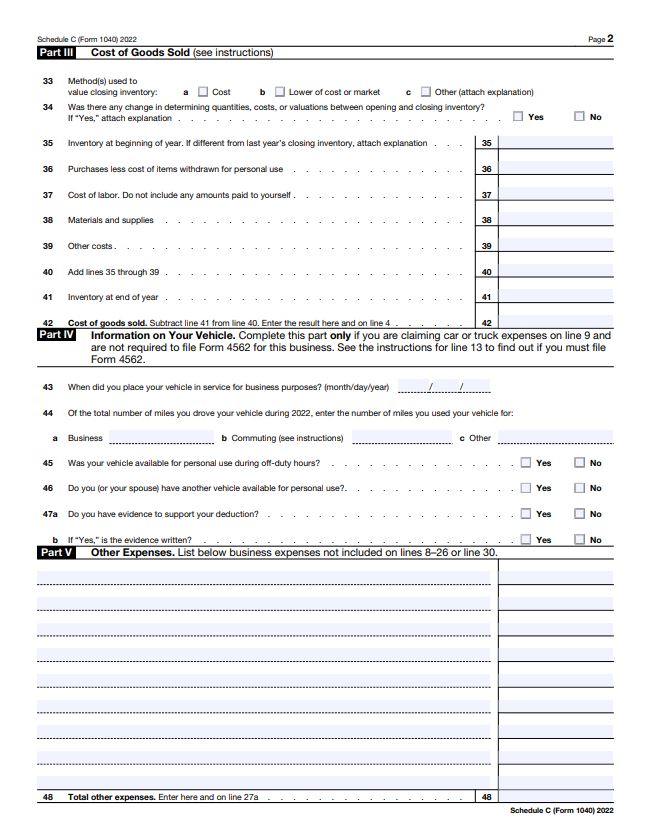

You can deduct the standard mileage deduction on Schedule C of your Form 1040. If you are a sole proprietor, you will claim the deduction on Schedule C. If you are a partner in a partnership, you will claim the deduction on Schedule K-1. If you are an employee, you will claim the deduction on Form 2106.

Example

Let’s say that you are a self-employed consultant who drives your car 10,000 miles for business purposes in 2023. You keep a log of all of your miles, and you have receipts for all of your expenses.

To calculate your deduction, you would multiply the standard mileage rate of 65.5 cents per mile by the number of miles you drove for business purposes, which is 10,000 miles. This gives you a deduction of $65,500.

You would then report this deduction on Schedule C of your Form 1040.

Conclusion

The standard mileage deduction is a valuable tax break for taxpayers who use their cars for business purposes. If you meet the requirements, you should consider taking the deduction to save money on your taxes.