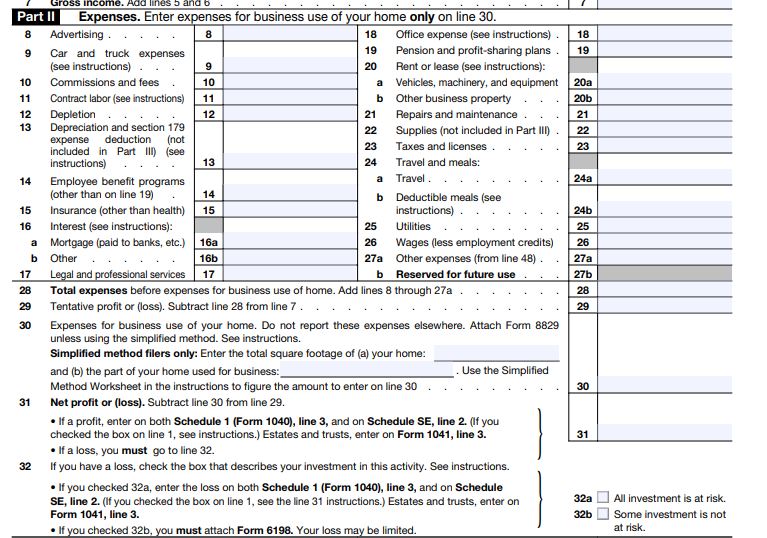

Here is a list of the expenses categories that are pre-filled on the Schedule C with a few examples of what you could put in each category:

- 1. Advertising

- Newspaper ads

- Magazine ads

- Online ads

- 3. Commissions and fees

- Sales commissions

- Professional fees

- Bank fees

- 5. Depletion

- Natural resource depletion

- Oil and gas depletion

- Timber depletion

- 7. Insurance (other than health)

- Liability insurance

- Property insurance

- Business interruption insurance

- 9. Legal and professional services

- Legal fees

- Accounting fees

- Consulting fees

- 11. Pension and profit-sharing plans

- SEP (Simplified Employee Pension) plans

- SIMPLE IRA plans

- 13. Repairs and maintenance

- Equipment repairs

- Machine repairs

- Office space repairs

- 17. Utilities

- Electricity

- Gas

- Water

- Cable/ Internet

- 15. Taxes and licenses

- Sales tax

- Property tax

- Business licenses

- 19. Depreciation

- 2. Car and truck expenses

- Gas

- Oil

- Repairs

- Insurance

- 4. Contract labor

- Independent contractor fees

- Freelancer fees

- Consultant fees

- 6. Employee benefit programs

- Health insurance

- Retirement plans

- Paid time off

- 8. Interest

- Business loan interest

- Credit card interest

- Mortgage interest

- 10. Office expense

- Paper

- Pens

- Staplers

- 12. Rent or lease

- Office space rent

- Equipment lease

- Vehicle lease

- 14. Supplies

- Packaging materials

- Office supplies

- Cleaning supplies

- 16. Travel and meals

- Airfare

- Hotel

- Meals

- 18. Wages and salaries

- Employee wages

- Salaries

- Bonuses

Not every business will use all of these categories, and you may have some expenses that don’t fit in any of these categories. There is a section on the Schedule C form where you can put your expenses that don’t fit these categories and give them your own description.