Page 2 of the Schedule C form has parts III, IV, and V. These sections are also used for expenses.

Part III

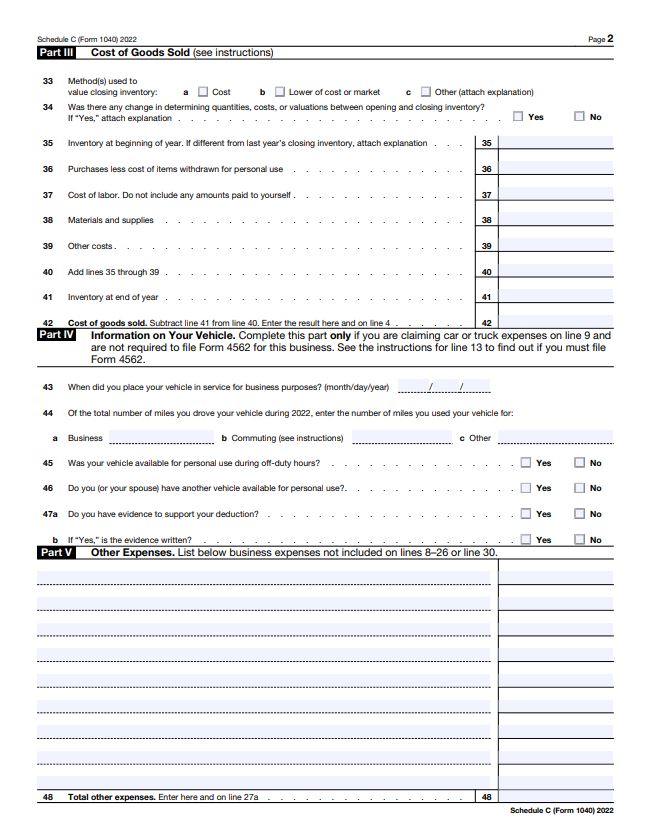

Part III of Schedule C is used to report the cost of goods sold for businesses that sell products. This section includes the following lines:

- Line 32: Beginning inventory

- Line 33: Cost of goods purchased

- Line 34: Cost of labor

- Line 35: Cost of materials and supplies

- Line 36: Other costs

- Line 37: Ending inventory

The total of these lines is subtracted from the gross receipts on line 1 to calculate the cost of goods sold. This number is then used to calculate the gross profit on line 4.

Part III of Schedule C is important because it helps to accurately determine the profitability of a business. By tracking the cost of goods sold, businesses can identify areas where they can reduce costs and improve their bottom line.

Part IV

Part IV of Schedule C is used to report information about the use of a vehicle for business purposes. If you use your personal vehicle for business, you can deduct certain expenses related to its use, such as gas, oil, and repairs. However, you must keep accurate records of your mileage and expenses in order to claim these deductions.

To report your vehicle expenses on Schedule C, you will need to provide the following information:

- The make, model, and year of your vehicle

- The date you acquired the vehicle

- The vehicle’s odometer reading at the beginning and end of the year

- The total miles you drove the vehicle for business purposes

- The total expenses you incurred for the vehicle, such as gas, oil, repairs, and insurance

You can claim the standard mileage rate for your vehicle expenses, or you can deduct the actual expenses you incurred. The standard mileage rate for 2023 is $0.585 per mile. If you choose to deduct the actual expenses, you will need to keep receipts for all of your expenses.

Part 4 of Schedule C is an important part of your tax return if you use your personal vehicle for business purposes. By accurately reporting your vehicle expenses, you can reduce your taxable income and save money on taxes.

Part V

Part 5 of Schedule C is used to report any other expenses that are not listed in Parts 1-4. This could include expenses such as office supplies, professional fees, or travel expenses. The total of these expenses is entered on line 27a.

The expenses reported on Part V are usually items that don’t fit into an of the categories already listed on the form in part II. You can use this section to enter expenses you have that are specific to your business. If you are a hair stylist you might put the amount you paid for clippers and scissors here. A restaurant/bar could put CO2 purchases here.

Leave a Reply

You must be logged in to post a comment.